Black Friday is a key period for every retail search team. With peak budgets, short buying windows, and mounting pressure to outperform competitors, retail marketers need a solid strategy.

Yet many advertisers enter Q4 with blind spots: uncertain what competitors are doing, unclear how market dynamics are shifting, and unsure where ad spend is underperforming.

To make matters more complex, the rise of Google’s AI Overviews pushes Shopping ads further down the page. Retail has the highest frequency of AI Overviews on long-tail queries at 82%, according to a recent Adthena study. These very searches often indicate high purchase intent.

This shift quietly erodes visibility on key terms that drive conversions, introducing new volatility into traffic and revenue projections ahead of Black Friday.

The cost of inaction or poor visibility is high. When CPCs spike unexpectedly, impression share plummets, or Performance Max campaigns deliver inconsistent results, the consequences aren’t just tactical, they’re commercial.

Why retail marketers face greater complexity than ever

This year’s Black Friday landscape is more competitive, more opaque, and more dynamic than in previous years. The pressure to deliver short-term results is intensified by factors that are outside most advertisers’ control:

- Changes in Google Ads, including double-serving and limited visibility in auction insights, make it harder to understand why you’re losing impression share.

- SERP volatility, with new formats like AI Overviews, is displacing traditional paid placements and disrupting the path to purchase.

- Performance Max campaigns offer more comprehensive reporting than before, but blur the lines between search and shopping insights, leaving gaps in channel-level performance.

This convergence of complexity is forcing retail marketers to reassess how they plan, monitor, and optimize their paid search strategy in Q4.

What most teams are still missing

Even well-resourced teams with solid campaign structures can fall short without clear visibility into five critical areas:

- Search term coverage: Are you appearing for all the high-intent terms your customers are searching for? Are competitors capturing demand you’re missing?

- Pricing: How do your prices compare to competitors in real-time?

- Offers and promotions: Are your offers and discounts competitive enough, and well timed?

- Budget allocation: Are you investing efficiently across brand, generic, and competitor terms? Or are your budgets heavily skewed with limited ROI?

- Brand protection: Are third-party sellers or competitors inflating your brand CPCs through infringements and brand bidding?

When these questions go unanswered, campaign performance is left to chance. And in the most critical retail trading period of the year, that’s a risk few advertisers can afford.

4 ways to boost search visibility now

There are several underused tools and tactics advertisers can apply immediately to uncover opportunities and mitigate risk before Black Friday hits:

Google Ads Transparency Center

You can get a sample view of what ads your competitors are running by looking up their domain.

Key limitations:

- Only provides a sample of live ads, not the full historical context.

- Displays ads only from verified advertisers.

- Requires manual checks, which are time-consuming at scale.

Google Merchant Center benchmarks

Check how your product pricing compares to benchmark prices for similar products.

Auction Insights and Keyword Planner

Get a directional view of competitive activity and seasonal search demand.

Key limitations:

- Auction Insights only shows up to 15 competitors in overlapping auctions, which means double-serving or emerging threats may not be visible.

- Impression share can be skewed by tactics like double-serving.

- Keyword Planner doesn’t provide visibility into competitor-specific insights or gaps in your own coverage.

YoY performance reviews

Identify what performed well (and what didn’t) last year to inform better decisions this year.

Key limitation:

- YoY data doesn’t reflect changes or visibility into the search landscape, such as the growing impact of AI Overviews or increased double-serving.

- As a result, performance benchmarks like impression share or CTR may no longer be directly comparable.

These tactics won’t give you a whole market view, but they can reveal blind spots and help you take action in areas you control, especially around price, timing, and term coverage.

What leading retail advertisers are doing differently

Leading retail advertisers aren’t relying on last year’s data or Google’s native reports alone. They’re gaining a competitive advantage across four critical areas:

- Adapting to AI Overviews: With AI Overviews appearing on 82% of long-tail retail queries, smart advertisers track how this SERP displacement affects their visibility on high-intent Black Friday terms and identify which competitors are maintaining share despite the changes.

- Real-time creative intelligence: They monitor when competitors launch new offers, which promotional messages are saturating the market, and how to differentiate their own Black Friday creative to avoid bidding wars on oversaturated terms.

- Competitive shopping analysis: Beyond basic feed management, they analyze how their product titles, pricing, and impression coverage compare to competitors in shared Shopping results, revealing gaps and informing Performance Max optimizations.

- Strategic market share tracking: Rather than distributing budgets historically, they identify where competitors are increasing spend, where new entrants are capturing demand, and where genuine growth opportunities exist.

How Adthena powers these strategies

1. AI Overview impact

With the rise of AI Overviews, advertisers need visibility into how Google’s results pages are actually changing in their category.

With Adthena’s Search Landscape dashboard, you can track visibility changes on critical Black Friday terms, giving you a live, tailored view of how the SERP is shifting in your specific market. Whether it’s AI Overviews or Product Listings, you can see which features are becoming more prominent and which are disappearing, across your critical search terms and competitors.

2. Ad copy insights

Monitor when and where competitors are launching offers to inform your timing and messaging.

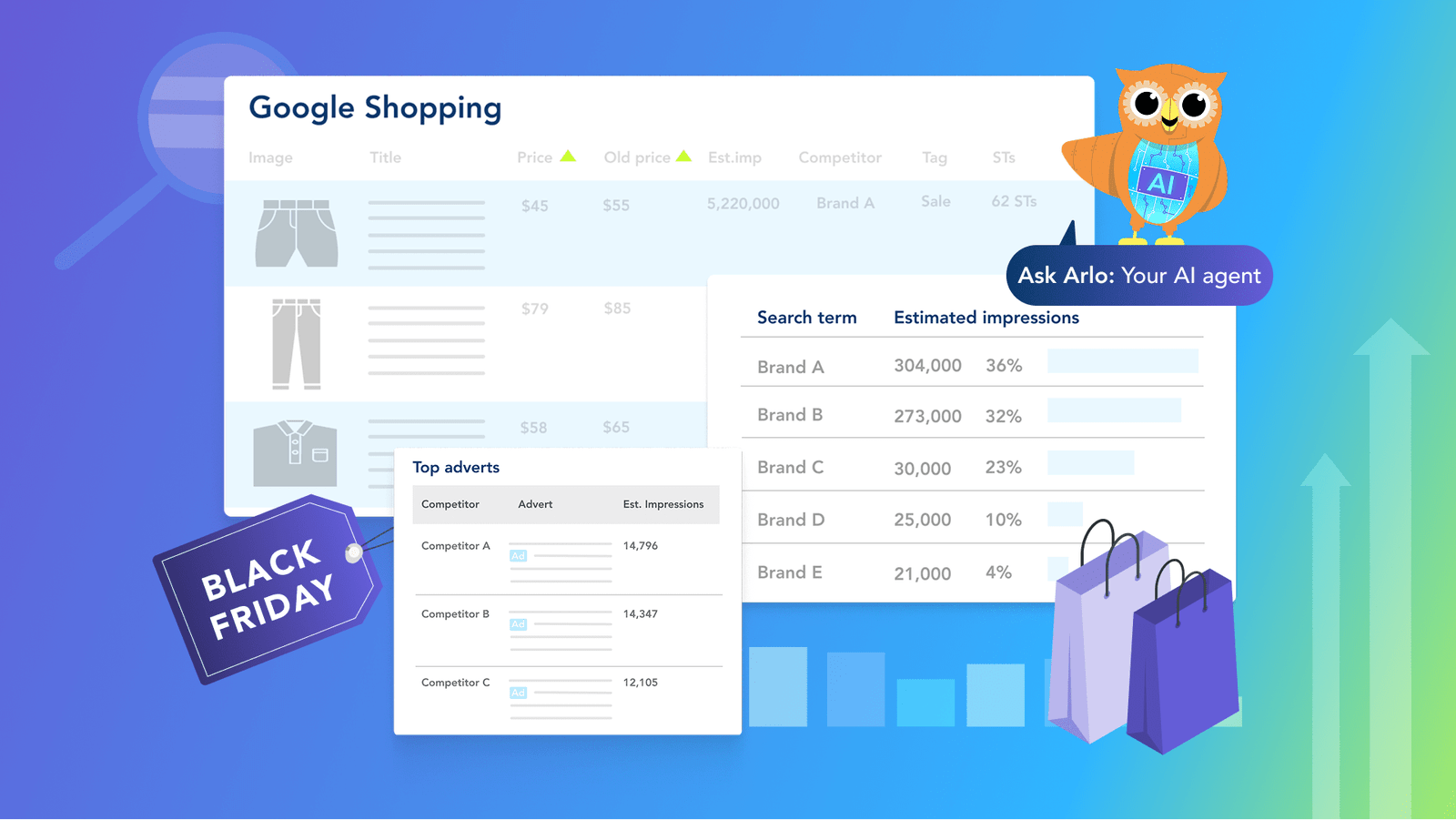

Adthena’s GenAI agent, Ask Arlo, can go that one step further and simplify your marketing campaigns by delivering instant, tailored insights in seconds to help you uncover competitive trends across your landscape.

“Arlo, could you create a brief summary of all the promotions and USPs the competitors used in their ad copy in October 2024? Please provide data in a table with a list of core promotions, themes, and USPs.”

3. Shopping intelligence

Compare pricing and presentation against competitors in shared results.

While Adthena captures all this raw competitive Shopping data, Ask Arlo transforms it into instant insights. For example, you can simply ask “Using Shopping data, show me how Competitors are discounting their products and which search term groups are being prioritized” and get immediate, actionable analysis that informs shopping optimizations.

4. PPC Market Share trends

Identify emerging threats and category shifts before they impact your performance.

From uncertainty to control: What retail marketers really need

Retail marketers don’t want more dashboards; they want clarity. They need to understand why CPCs are spiking, which competitor just launched an aggressive offer, and where their campaigns are underperforming.

What they’re seeking is confidence that:

- Budgets are working efficiently.

- They aren’t missing valuable demand.

- They can defend performance when questioned.

In Black Friday’s high-pressure environment, having competitive intelligence that turns reactive scrambling into proactive strategy is key.

Preparing for peak season success

Success this season comes from preparation, not panic spending. Before the rush begins:

- Audit your competitive blind spots: Identify gaps in keyword targeting and visibility.

- Benchmark your market position: Understand how your pricing and offers stack up before the promotional battle intensifies.

- Optimize your Shopping presence: Ensure product titles and pricing can compete in Shopping results.

- Rebalance budget allocation: Shift spend toward genuine opportunities rather than defensive bidding.

- Set up proactive monitoring: Don’t wait to react. Track competitor moves as they happen.

Now is the time to shift from reactive to proactive.

Ready to gain the competitive edge that transforms Black Friday performance? Connect with Adthena today.