The status of auto-entrepreneur (or micro-entrepreneur) is designed to easily create an independent professional activity, which is carried out in the commercial, craft sector or as a liberal profession. The formalities for creating the self-enterprise are simple, with quick and accessible procedures. Here is everything you need to know to become a self-entrepreneur!

Become a 5-step self-employed

The micro-enterprise regime aims to allow the simple launch of an independent activity, whether main or complementary. It is therefore quick to create your self-employed status and start to exercise. Here are the 5 steps to start.

1. Declare your activity

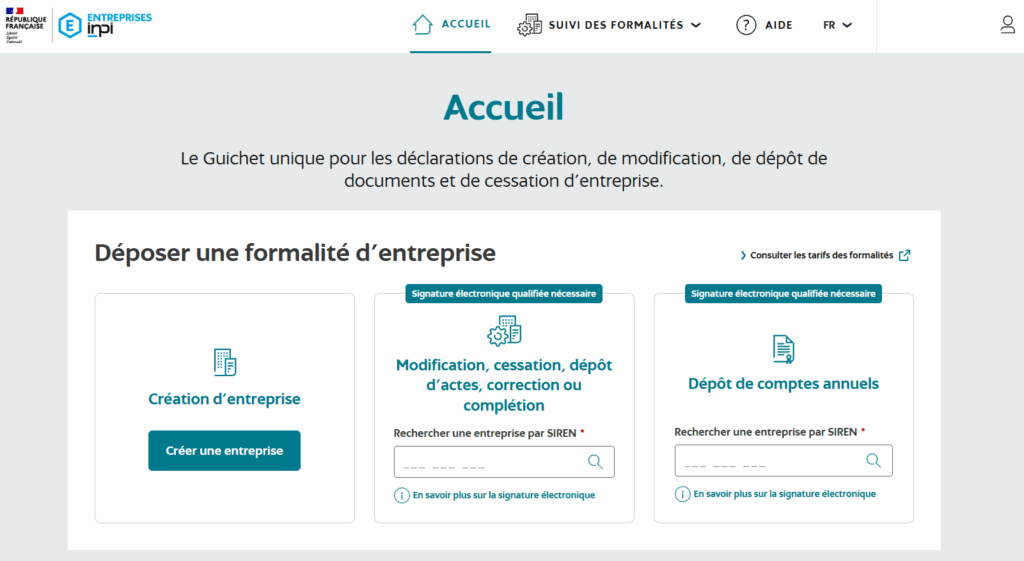

The first thing to do is to declare the creation of the activity that we will exercise as a self-entrepreneur. This is done with the Single window of the INPI by clicking on Create, modify or stop a businessThen Business creation. It is necessary to provide an identity document and its personal information: Social Security number, non-CONDAMNATION Declaration and possibly residence permit.

2. Define the tax and social framework

It is when submitting a file on the one -stop shop that the social and fiscal component must be completed with the activity. It is then necessary to choose the periodicity of declaration of turnover and the payment of social contributions: this is done monthly or quarterly, even if the turnover is zero. It is also at this stage that the tax options must be chosen, that is to say the classic tax regime or the release payment. Simulations are offered to make your choice.

For any information before or during the filing of the creation file, you can consult formalities.entreprises.gouv.fr.

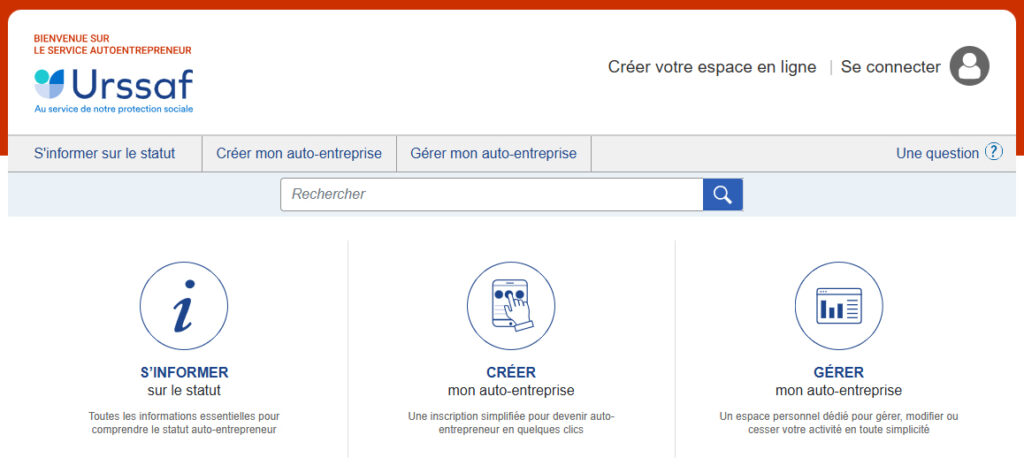

3. Register for URSSAF

Once registered at the one -stop shop, it is necessary Create an URSSAF space. The site centralizes all the online services of self-employed entrepreneurs when they are affiliated. If you are eligible for acre, it is when creating the URSSAF space that the request must be made.

The registration file is then processed by the administration: it takes an average of two weeks to receive your SIRET and be able to invoice, and therefore start your activity as a entrepreneur. You can also access the online services of the URSSAF, declare its turnover and pay your contributions.

4. Open a bank account

It is not compulsory to have a bank account dedicated to self-enterprise when you create it, nevertheless it is highly recommended. It is indeed necessary as soon as turnover exceeds € 10,000 for two consecutive calendar years. And even when you do not meet this criterion, it is preferable to clarify your accounts by separating pro and personal accounts.

5. Ensure his activity

Even under self-employed status, Professional insurance is compulsory for certain activities (Denial insurance in the building trades, for example). Note, however, that, even optional, professional civil liability insurance is highly recommended for any activity. Take the time to take stock of your existing contracts and possible new needs.

Why become self-employed?

Micro-enterprise or self-enterprise is an sole proprietorship benefiting from a simplified tax and social regime. This status takes advantage of very interesting advantages to start an activity as a freelance or liberal.

Simplified creation procedures

The business creation formalities are very simple when you become a self-entrepreneur. No need for statutes as in a company: registration with the INPI is done through a quick form to be completed. In just two weeks, we have a siret and can be charged.

Simplified accounting

The accounting of auto-entrepreneurs is ultra-esimple. It is limited to the holding of revenue and purchases related to the activity, and to the declaration of turnover.

In micro-enterprise, we are very often exempt from VAT: this reduces the procedures and allows you to charge at competitive prices. The VAT database deductible is up to a certain turnover threshold: in 2025, it is set at € 85,000 for goods for sale of goods and € 37,500 for the provision of services.

Simple and clear social contributions

The self-employed status is based on the micro-social diet. It is a simplified diet that wants to pay the contributions according to your turnover: if you have no turnover, you don't pay any load. In addition, the rate of contributions and social contributions is fixed and provided in advance, knowing that it is defined according to the sector of activity: this makes it possible to always know what we will have to pay.

Lightened taxation

Auto-entrepreneurs also benefit from a reduction in tax obligations: we are talking about a micro-fiscal diet. The taxable income takes into account an automatic reduction for costs, which exempts to declare its costs to the real.

In addition, as a entrepreneur we can benefit from the Revenue tax payment. The tax is then to be paid at the same time as the contributions, on the basis of a specific fixed rate ranging from 1 to 2.2% depending on the nature of the activity carried out.

Flexibility and limited risks

Becoming a self-employed person allows you to get started without taking any risks. On the one hand, because the contributions and taxes depend on the turnover: if you cash 0 €, you pay 0 €.

On the other hand, because we can combine self-enterprise with a main salaried activity or a retirement pension. This makes it possible to generate additional income and also to try entrepreneurship by keeping the safety of your main job. If necessary, the self-enterprise can easily be closed or the status evolve.

Aids to become self-employed

There are several possible aids to create its micro-enterprise:

- We can apply forAcre (Help in creating or taking over a business). This advantageous system makes it possible to be partially exempt from social charges in the first year of the activity. It must be asked for the URSSAF when submitting the self-enterprise file.

- There are also local aid possible for financing or support. Do not hesitate to consult those offered by your region, department or commune. The chambers of shops also sometimes offer specific bonuses or scholarships, as well as certain networks of entrepreneurs. For people with disabilities, there are also AIDS OF AGEFIPH To become a self-employed.

- Finally, as an entrepreneur, we benefit from a right to vocational training. To do this, it must have declared a turnover during the 12 months sold, since the contribution to vocational training (CFP) is part of the contributions paid.

How much does it cost to become a self-employed entrepreneur?

Before deciding to become self-employed, it is important to understand what it will cost you. And good news: the creation of the activity is done for free!

Registration fees

The steps to be taken to become a self-entrepreneur are free. Registration in the business register and obtaining a SIRET is done at no cost, which makes this status extremely practical and accessible to the greatest number.

The only exception concerns commercial agents: registration is then compulsory with the special register, at a price of € 23.56.

In addition, craftsmen who become self-employed people will be advisable to carry out an installation preparation course (SPI), although it is optional. This is billed by the Chambers of Trades and Crafts: count around 200 €.

Contributions, charges and additional costs

Certain additional costs may, however, arise once you are installed as an entrepreneur.

It is indeed recommended toBank account dedicated to activity in order to better manage its accounts. It is even compulsory from € 10,000 in turnover over two consecutive years. For this, you must therefore provide account management fees from your bank.

It is also compulsory to take out insurance For certain professional activities, and greatly recommended for all self-employed entrepreneurs. Added to this are the conventional operating expenses, such as the purchase of equipment and travel costs.

Once self-employed, you will also have to pay various contributions:

- Social contributions and compulsory charges: Despite the principle of the micro-social, there are contributions to pay, based on the turnover declared each month or quarter.

- The Land Contribution of Business (CFE): to be paid each year, except the first. Its amount depends on the municipality and the tax rate.

The conditions for becoming a self-employed

The sine qua non condition to obtain the status of self-employed entrepreneur is not to exceed a certain turnover threshold. This is capped, with a limit set in 2025 to:

- € 77,700 for the provision of services

- € 188,700 for the activities of purchase/resale of goods, sale of foodstuffs to be consumed on site and accommodation services (excluding furnished rental)

On the other hand, it is necessary to exercise an activity responding to framework provided for self-employed status. It can be a craft, commercial or liberal activity. Also note that a natural person can only have one micro-enterprise but to combine several activities.

Finally, and despite the facilities granted, being self-employed requires respecting certain obligations:

- Accounting obligations: Edit legal invoices for its customers, manage its activity via a dedicated bank account (beyond € 10,000 received per year over two years), keep a book of revenue as well as a purchase register when you are a merchant.

- Social and tax obligations: Paying social security contributions, declaring your turnover every month or quarters, paying income tax and, depending on the activity carried out, paying the land contribution of companies.

Becoming a self-entrepreneur remains a simple and easy approach to perform. You can very easily get this status and, for example, Join the Coder.com freelance panel.com !